Patience Pays: How a Funded Trader Cashed in on a $2,700 Trade

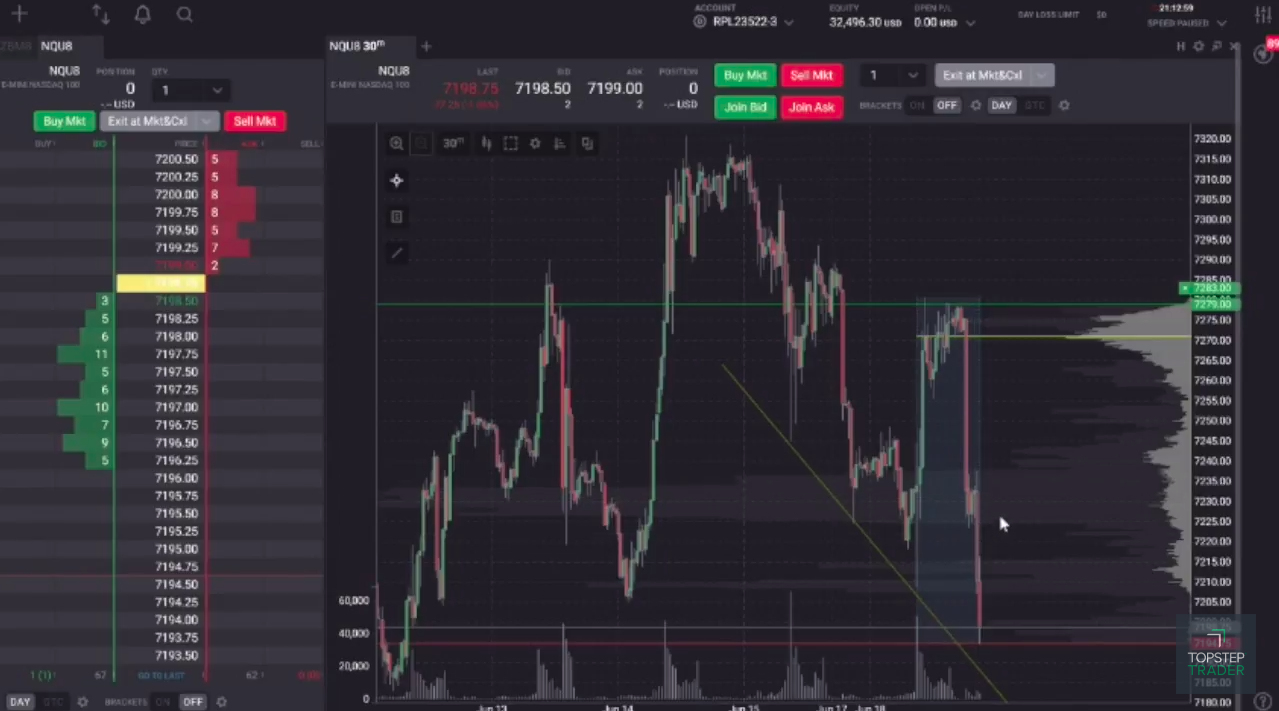

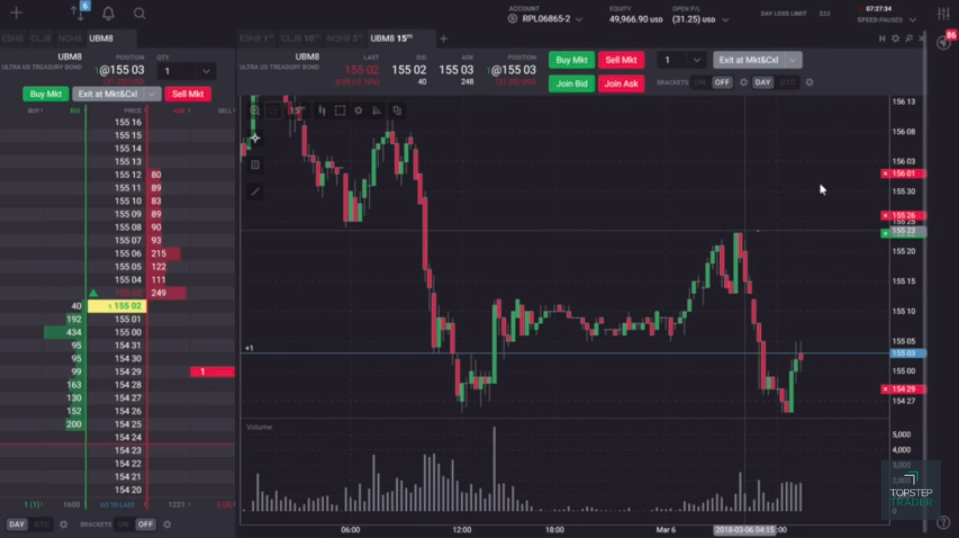

Imagine being in one trade over four days, watching your P&L go up $1,000 to even, back to up $1,000 to even as the market gyrates 40-50 pips over hours. Your long bias is still valid, so you sit in...