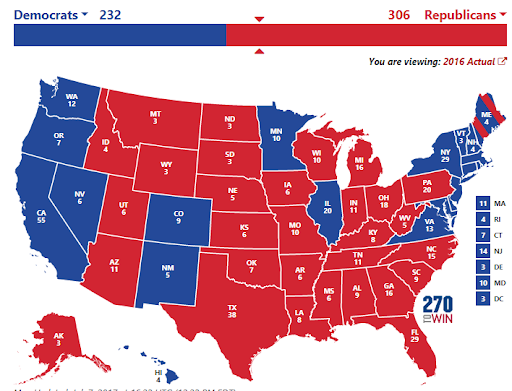

[VIDEO] Trading Around the Election - The Coach’s Playbook

Are elections a good time to look for trading opportunities? This year, we saw how unpredictable the markets could be during periods of uncertainty under extreme circumstances. Election cycles are...

.png)