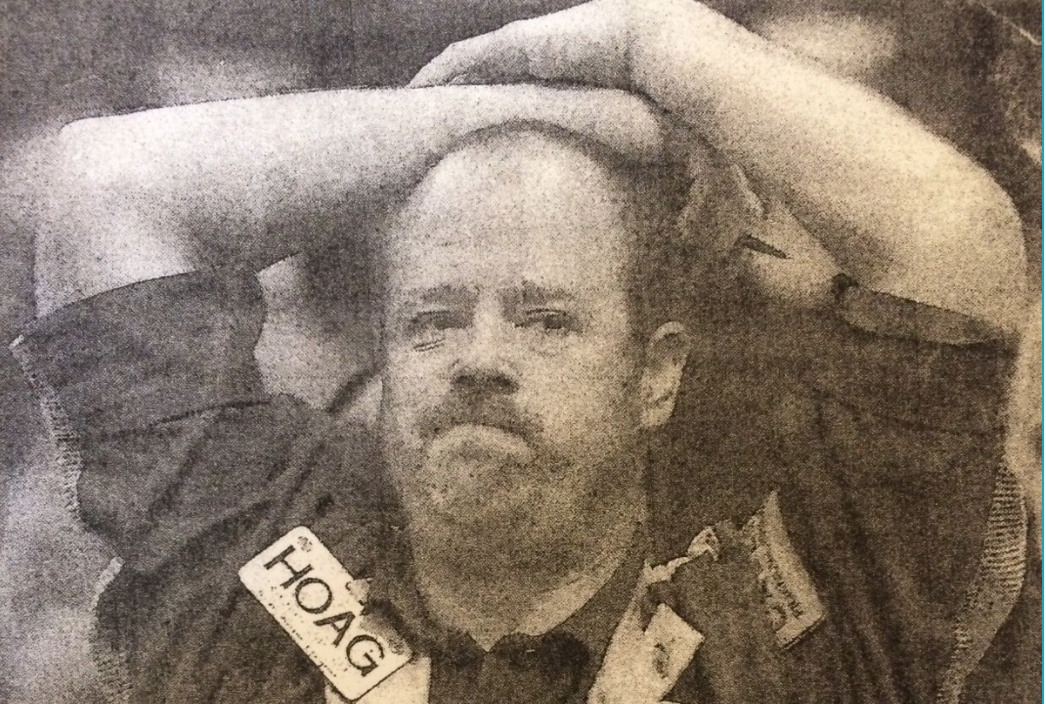

Weekend Kickoff Levels from John Hoagland 11/22/20

Every Friday afternoon, Topstep Performance Coach John Hoagland fires up his charts and identifies the trends and "areas of importance" futures traders should look out for in the coming week. Read on...