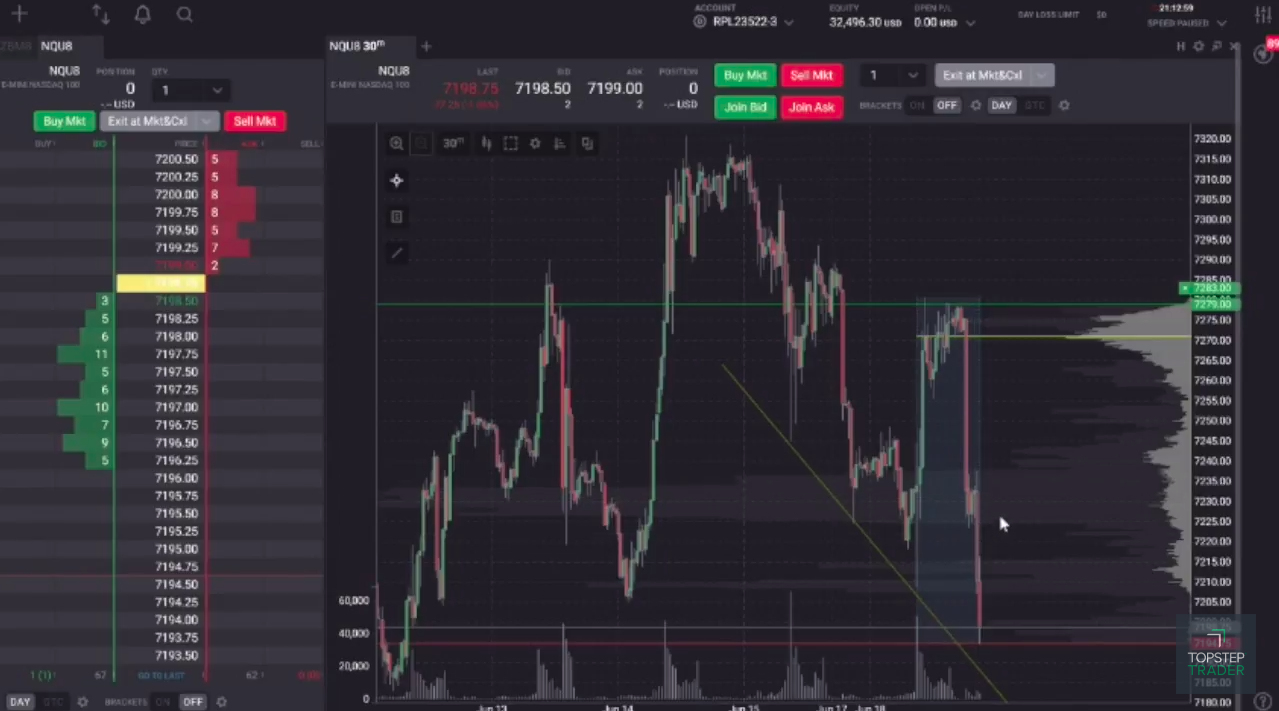

Funded Trader: $2,300 in Profits Riding Nasdaq to New Highs

We say it often — trading is all about your risk-to-reward ratio. In this trade, Brad M. from Chicago nailed going long Nasdaq ($NQ) futures and riding one contract for more than 100 points and...